| 1. | | Amount Previously Paid: |

| | 2. | (1) | | Amount previously paid: | | | (2) | | Form, Schedule or Registration Statement No.:No: | | | (3) | | Filing party: | | | (4) | | Date Filed: |

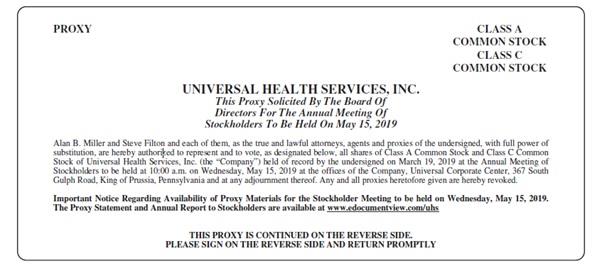

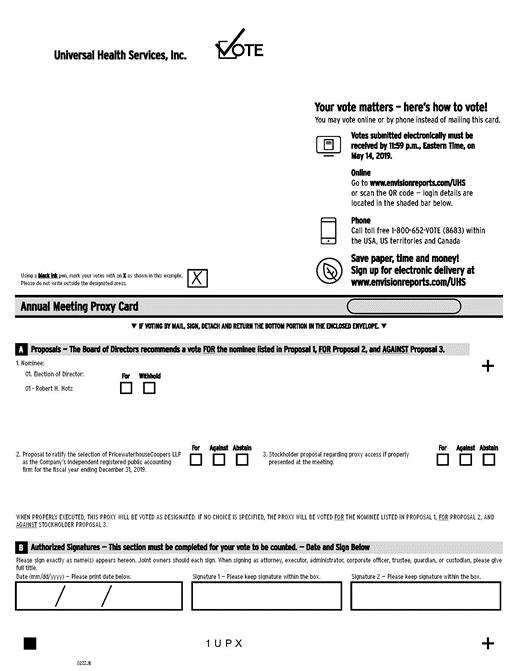

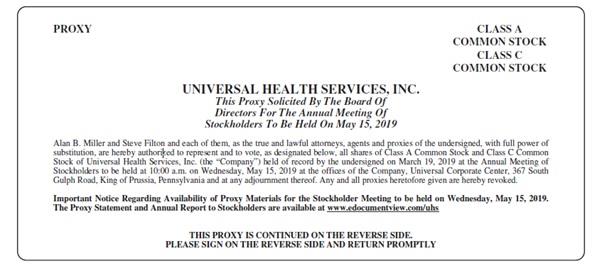

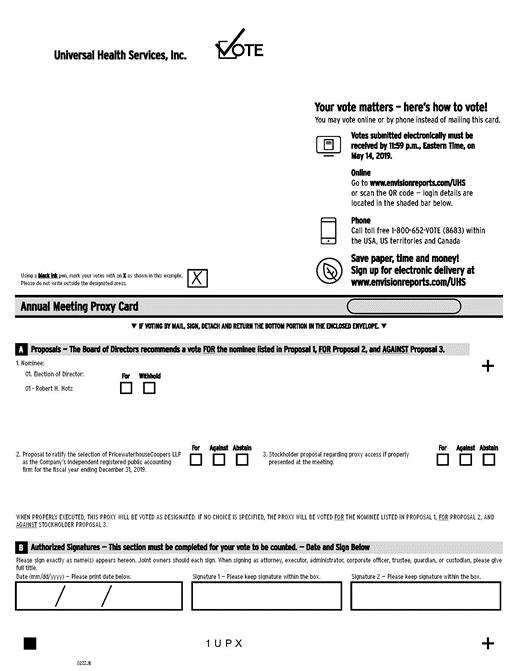

UNIVERSAL HEALTH SERVICES, INC. April 7, 20164, 2019 Dear Stockholder: You are cordially invited to attend the Annual Meeting of Stockholders of Universal Health Services, Inc. (the “Company”) to be held at the offices of the Company, Universal Corporate Center, 367 South Gulph Road, King of Prussia, Pennsylvania, on Wednesday, May 18, 2016,15, 2019, at 10:00 a.m., for the following purposes: | (1) | the election of one director by the holders of Class A and Class C Common Stock (voting together as a single class) and the election of one director by the holders of Class B and Class D Common Stock;Stock (voting together as a single class); |

| (2) | the ratification of the selection of PricewaterhouseCoopers LLP as the Company’sour independent registered public accounting firm for the fiscal year ending December 31, 2016;2019; |

| (3) | to act on a shareholderstockholder proposal regarding proxy access if properly presented at the meeting; and |

| (4) | the transaction of such other business as may properly come before the meeting or any adjournment thereof. |

Detailed information concerning these matters is set forth in the Important Notice Regarding the Availability of Proxy Materials (the “Notice”) you received in the mail and in the attached Notice of Annual Meeting of Stockholders and Proxy Statement. We have elected to provide access to our Proxy Materials over the internet under the Securities and Exchange Commission’s “notice and access” rules. If you want more information, please see the Questions and Answers section of this Proxy Statement. Your vote is important. Whether or not you plan to attend the meeting, please either vote by telephone or internet or, if you received printed Proxy Materials and wish to vote by mail, by promptly signing and returning your Proxy card in the enclosed envelope. Please review the instructions on each of your voting options described in this Proxy Statement as well as in the Notice you received in the mail. If you then attend and wish to vote your shares in person, you still may do so. In addition to the matters noted above, we will discuss the business of the Company and be available for your comments and discussion relating to the Company. I look forward to seeing you at the meeting. | | Sincerely, | |

| Alan B. Miller | Chairman and | Chief Executive Officer |

UNIVERSAL HEALTH SERVICES, INC. UNIVERSAL CORPORATE CENTER 367 SOUTH GULPH ROAD KING OF PRUSSIA, PENNSYLVANIA 19406 NOTICE OF ANNUAL MEETING OF STOCKHOLDERS May 18, 201615, 2019 Notice is hereby given that the Annual Meeting of Stockholders (the “Annual Meeting”) of Stockholders of Universal Health Services, Inc. (the “Company”) will be held on Wednesday, May 18, 201615, 2019 at 10:00 a.m., at the offices of the Company, Universal Corporate Center, 367 South Gulph Road, King of Prussia, Pennsylvania for the following purposes: | (1) | the election of one director by the holders of Class A and Class C Common Stock (voting together as a single class) and the election of one director by the holders of Class B and Class D Common Stock;Stock (voting together as a single class); |

| (2) | the ratification of the selection of PricewaterhouseCoopers LLP as the Company’sour independent registered public accounting firm for the fiscal year ending December 31, 2016;2019; |

(3)to act on a stockholder proposal regarding proxy access if properly presented at the meeting; and | (3)(4) | to act on a shareholder proposal regarding proxy access if properly presented at the meeting; and |

| (4) | the transaction of such other business as may properly come before the meeting or any adjournment thereof. |

You are entitled to vote at the Annual Meeting only if you were a Company stockholder of record at the close of business on March 22, 2016.19, 2019. You are cordially invited to attend the Annual Meeting in person. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE VOTE BY TELEPHONE OR INTERNET OR, IF YOU RECEIVED PRINTED PROXY MATERIALS AND WISH TO VOTE BY MAIL, MARK YOUR VOTES, THEN DATE AND SIGN THE ENCLOSED FORM OF PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED POSTAGE-PAID ENVELOPE. YOU MAY REVOKE YOUR PROXY IF YOU DECIDE TO ATTEND THE ANNUAL MEETING AND WISH TO VOTE YOUR SHARES IN PERSON. Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on Wednesday, May 18, 2016:15, 2019: The Proxy Statement and Annual Report to Stockholders are available at http://www.edocumentview.com/uhs. | | BY ORDER OF THE BOARD OF DIRECTORS | |

| |

| STEVE G. FILTON,Secretary |

King of Prussia, Pennsylvania April 7, 2016 4, 2019

UNIVERSAL HEALTH SERVICES, INC. UNIVERSAL CORPORATE CENTER 367 SOUTH GULPH ROAD KING OF PRUSSIA, PA 19406 PROXY STATEMENT QUESTIONS AND ANSWERS 1. | Q: Why am I receiving these materials? |

| A: | This Proxy Statement and enclosed forms of Proxy (first mailed to the holders of Class A and Class C Common Stock, and to the holders of Class B and Class D Common Stock who requested to receive printed Proxy Materials, on or about April 7, 2016)4, 2019) are furnished in connection with the solicitation by our Board of Directors of Proxies for use at the Annual Meeting of Stockholders, or at any adjournment thereof. A Notice Regarding the Availability of Proxy Materials was first mailed to all of our other stockholders beginning on or about April 7, 2016.4, 2019. The Annual Meeting will be held on Wednesday, May 18, 201615, 2019 at 10:00 a.m., at our offices located at Universal Corporate Center, 367 South Gulph Road, King of Prussia, Pennsylvania. As a stockholder, you are invited to attend the Annual Meeting and are requested to vote on the items of business described in this Proxy Statement. |

2. | Q: What is the purpose of the Annual Meeting? |

| A: | The Annual Meeting is being held (1) to have the holders of Class A and C Common Stock (voting together as a single class) elect one Class II director and to have the holders of Class B and D Common Stock (voting together as a single class) elect one Class II director, each such director to serve for a term of three years until the annual election of directors in 2019 and2022 or the election and qualification of his respective successor; (2) to have the holders of Class B and D Common Stock elect one Class II director to serve for a term of three years until the annual election of directors in 2019 and the election and qualification of his successor (3) the ratification of the selection of PricewaterhouseCoopers LLP as the Company’sour independent registered public accounting firm for the fiscal year ending December 31, 2016; (4)2019; (3) to act on a shareholderstockholder proposal regarding proxy access if properly presented at the meeting; and (5)(4) to transact such other business as may properly be brought before the meeting or any adjournment thereof. We will also discuss our business and be available for your comments and discussion. |

3. | Q: Why did holders of Class B and Class D Common Stock receive a notice in the mail regarding the internet availability of Proxy Materials instead of a full set of Proxy Materials? |

| A: | In accordance with “notice and access” rules adopted by the U.S. Securities and Exchange Commission, or SEC, we may furnish Proxy Materials, including this Proxy Statement and our Annual Report to Stockholders, to our stockholders by providing access to such documents on the internet instead of mailing printed copies. Most holdersHolders of Class B and Class D Common Stock will not receive |

1

| printed copies of the Proxy Materials unless they request them. Instead, the Notice, which was mailed to holders of Class B and Class D Common Stock that did not request printed copies of the Proxy Materials, will instruct you as to how you may access and review all of the Proxy Materials on the internet. Please visit http://www.edocumentview.com/uhs. The Notice also instructs you as to how |

| | you may submit your Proxy on the internet. If you would like to receive a paper or e-mail copy of our Proxy Materials, you should follow the instructions for requesting such materials in the Notice. |

4. | Q: Who may attend the Annual Meeting? |

| A: | Stockholders of record as of the close of business on March 22, 2016,19, 2019, or their duly appointed Proxies, may attend the meeting. Stockholders whose shares are held through a broker or other nominee will need to bring a copy of a brokerage statement reflecting their ownership of our Common Stock as of the record date. |

5. | Q: Who is entitled to vote at the Annual Meeting? |

| A: | Only stockholders of record as of the close of business on March 22, 201619, 2019 are entitled to vote at the Annual Meeting. On that date, 6,595,3086,577,100 shares of Class A Common Stock, par value $.01 per share, 663,940661,688 shares of Class C Common Stock, par value $.01 per share, 90,014,03683,842,101 shares of Class B Common Stock, par value $.01 per share, and 23,12218,653 shares of Class D Common Stock, par value $.01 per share, were outstanding. |

6. | Q: Who is soliciting my vote? |

| A: | The principal solicitation of Proxies is being made by the Board of Directors by mail. Certain of our officers, directors and employees, none of whom will receive additional compensation therefor, may solicit Proxies by telephone or other personal contact. We will bear the cost of the solicitation of the Proxies, including postage, printing and handling and will reimburse the reasonable expenses of brokerage firms and others for forwarding material to beneficial owners of shares. We have not engaged any third party to assist us in solicitation of proxies at the Annual Meeting, but we may decide to retain the services of a proxy solicitation firm in the future if we believe it is appropriate under the circumstances. |

7. | Q: What items of business will be voted on at the Annual Meeting? |

| A: | The holders of Class A and C Common Stock (voting together as a single class) will elect one Class II director and the holders of Class B and Class D Common Stock (voting together as a single class) will elect one Class II director, each such director to serve for a term of three years until the annual election of directors in 2019. The holders2022 or the election and qualification of Class B and D Common Stock will elect one Class II director, to serve for a term of three years until the annual election of directors in 2019.his respective successor. The holders of Class A, Class C, Class B and Class D Common Stock (voting together as a single class) will vote on the following matters: ratification of the selection of PricewaterhouseCoopers LLP as the Company’sour independent registered public accounting firm for the fiscal year ending December 31, 2016;2019; and a shareholderstockholder proposal regarding proxy access if properly presented at the meeting.access. |

2

8. | Q: How does the Board of Directors recommend that I vote? |

| A: | The Board of Directors recommends that holders of Class A and Class C Common Stock and Class B and Class D Common Stock vote shares “FOR” the election of the respective nominees to the Board of Directors (Proposal 1). |

The Board of Directors recommends that holders of Class A, Class C, Class B and Class D Common Stock vote shares “FOR” the ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 20162019 (Proposal 2).

The Board of Directors recommends that holders of Class A, Class C, Class B and Class D Common Stock vote shares “AGAINST” the shareholderstockholder proposal regarding proxy access, if properly presented at the meeting; (Proposal 3). 9. | Q: How will voting on any other business be conducted? |

| A: | Other than the items of business described in this Proxy Statement, we know of no other business to be presented for action at the Annual Meeting. As for any business that may properly come before the Annual Meeting, your signed Proxy gives authority to the persons named therein. Those persons may vote on such matters at their discretion and will use their best judgment with respect thereto. |

10. | Q: What is the difference between a “stockholder of record” and a “street name” holder? |

| A: | These terms describe how your shares are held. If your shares are registered directly in your name with Computershare, our transfer agent, you are a “stockholder of record.” If your shares are held in the name of a brokerage, bank, trust or other nominee as a custodian, you are a “street name” holder. |

11. | Q: How do I vote my shares if I am a stockholder of record? |

| A: | A separate form of Proxy applies to our Class A and Class C Common Stock and a separate form of Proxy applies to our Class B and Class D Common Stock. For specific instructions on how to vote your shares, please refer to the instructions on the Notice Regarding the Availability of Proxy Materials you received in the mail or, if you received printed Proxy Materials, your enclosed Proxy card. If you received printed Proxy Materials, enclosed is a Proxy card for the shares of stock held by you on the record date. If you received printed Proxy Materials, you may vote by signing and dating each Proxy card you receive and returning it in the enclosed prepaid envelope, or you may vote by telephone or internet. Unless otherwise indicated on the Proxy, shares represented by any Proxy will, if the Proxy is properly executed and received by us prior to the Annual Meeting, be voted “FOR” each of the nominees for director; “FOR the ratification of the selection of PricewaterhouseCoopers LLP as the Company’sour independent registered public accounting firm for the fiscal year ending December 31, 2016;2019; and “AGAINST” the shareholderstockholder proposal regarding proxy access, if properly presented at the meeting. |

3

12. | Q: How do I vote by telephone or electronically? |

| A: | Instead of submitting your vote by mail on the enclosed Proxy card (if you received printed Proxy Materials), your vote can be submitted by telephone or electronically, via the internet. Please refer to the specific instructions set forth on the Notice Regarding the Availability of Proxy Materials or, if you received printed Proxy Materials, on the enclosed Proxy card. For security reasons, our electronic voting system has been designed to authenticate your identity as a stockholder. |

13. | Q: How do I vote my shares if they are held in street name? |

| A: | If your shares are held in street name, your broker or other nominee will provide you with a form seeking instruction on how your shares should be voted. |

14. | Q: Can I change or revoke my vote? |

| A: | Yes. Any Proxy executed and returned to us is revocable by delivering a later signed and dated Proxy or other written notice to our Secretary at any time prior to its exercise. Your Proxy is also subject to revocation if you are present at the meeting and choose to vote in person. |

15. | Q: What is the vote required to approve each proposal? |

| A: | The director nominee receiving the highest number of affirmative votes of the shares of Class A and Class C Common Stock, voting as a class, present in person or represented by Proxy and entitled to vote, a quorum being present, shall be elected as Class II director. The director nominee receiving the highest number of affirmative votes of the shares of Class B and Class D Common Stock, voting as a class, present in person or represented by Proxy and entitled to vote, a quorum being present, shall be elected as Class II director. The affirmative vote of the holders of a majority of the Class A, B, C and D Common Stock votes, present in person or represented by Proxy and entitled to vote on the matter is required to approve each proposal other than the election of directors. |

16. | Q: What constitutes a “quorum”? |

| A: | The holders of a majority of the common stock votes issued and outstanding and entitled to vote, either in person or represented by Proxy, constitutes a quorum. Proxies received but marked as |

| | abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting. |

17.16. | Q: What are our voting rights with respect to the election of directors? |

| A: | Our Restated Certificate of Incorporation provides that, with respect to the election of directors, holders of Class A Common Stock vote as a class with the holders of Class C Common Stock, and holders of Class B Common Stock vote as a class with holders of Class D Common Stock, with holders of all classes of Common Stock entitled to one vote per share. |

As of March 22, 2016,19, 2019, the shares of Class A and Class C Common Stock constituted 7.5%7.9% of the aggregate outstanding shares of our Common Stock, had the right to elect five members of the Board of 4

Directors and constituted 86.4%87.2% of our general voting power; and as of that date the shares of Class B and Class D Common Stock (excluding shares issuable upon exercise of options) constituted 92.5%92.1% of the outstanding shares of our Common Stock, had the right to elect two members of the Board of Directors and constituted 13.6%12.8% of our general voting power. 18.17. | Q: What are our voting rights with respect to matters other than the election of directors? |

| A: | As to matters other than the election of directors, our Restated Certificate of Incorporation provides that holders of Class A, Class B, Class C and Class D Common Stock all vote together as a single class, except as otherwise provided by law. |

Each share of Class A Common Stock entitles the holder thereof to one vote; each share of Class B Common Stock entitles the holder thereof to one-tenth of a vote; each share of Class C Common Stock entitles the holder thereof to 100 votes (provided the holder of Class C Common Stock holds a number of shares of Class A Common Stock equal to ten times the number of shares of Class C Common Stock that holder holds); and each share of Class D Common Stock entitles the holder thereof to ten votes (provided the holder of Class D Common Stock holds a number of shares of Class B Common Stock equal to ten times the number of shares of Class D Common Stock that holder holds). In the event a holder of Class C or Class D Common Stock holds a number of shares of Class A or Class B Common Stock, respectively, less than ten times the number of shares of Class C or Class D Common Stock that holder holds, then that holder will be entitled to only one vote for every share of Class C Common Stock, or one-tenth of a vote for every share of Class D Common Stock, which that holder holds in excess of one-tenth the number of shares of Class A or Class B Common Stock, respectively, held by that holder. The Board of Directors, in its discretion, may require holders of Class C or Class D Common Stock to provide satisfactory evidence that such owner holds ten times as many shares of Class A or Class B Common Stock as Class C or Class D Common Stock, respectively, if such facts are not apparent from our stock records. 19.18. | Q: What if I abstain from voting or withhold my vote? |

| A: | Stockholders entitled to vote for the election of directors can abstain from voting or withhold the authority to vote for any nominee. If you attend the meeting or send in your signed Proxy with instructions to withhold authority to vote for one or more nominees, you will be counted for the purposes of determining whether a quorum exists. Abstentions and instructions on the accompanying Proxy card to withhold authority to vote will result in the respective nominees receiving fewer votes. However, the number of votes otherwise received by the nominee will not be reduced by such action. |

20. | Q: Will my shares be voted if I do not sign and return my Proxy card or vote by telephone or internet? |

| A: | If you are a stockholder of record and you do not sign and return your Proxy card or vote by telephone or internet, your shares will not be voted at the Annual Meeting. If your shares are held in street name and you do not issue instructions to your broker, your broker may vote your shares at its discretion on routine matters, but may not vote your shares on nonroutine matters. Under the New York Stock |

5

| Exchange rules, each of the proposals other than the ratification of the selection of the Company’s independent registered public accounting firm is deemed to be a nonroutine matter with respect to which brokers and nominees may not exercise their voting discretion without receiving instructions from the beneficial owner of the shares. |

21.19. | Q: What is a “broker non-vote”? |

| A: | “Broker non-votes” are shares held by brokers or nominees which are present in person or represented by Proxy, but which are not voted on a particular matter because instructions have not been received from the beneficial owner. Under the rules of the Financial Industry Regulatory Authority, member brokers generally may not vote shares held by them in street name for customers unless they are permitted to do so under the rules of any national securities exchange of which they are a member. Under the rules of the New York Stock Exchange, New York Stock Exchange-member brokers who hold shares of Common Stock in street name for their customers and have transmitted our Proxy solicitation materials to their customers, but do not receive voting instructions from such customers, are not permitted to vote on nonroutine matters. Under the New York Stock Exchange rules, each of the proposals other than the ratification of the selection of the Company’s independent registered public accounting firm is deemed to be nonroutine matters with respect to which brokers and nominees may not exercise their voting discretion without receiving instructions from the beneficial owner of the shares. |

22.20. | Q: What is the effect of a broker non-vote? |

| A: | Broker non-votes will be counted for the purpose of determining the presence or absence of a quorum but they dowill not affectbe considered present and entitled to vote on any matter for which a broker, bank or other nominee does not have authority. For the determinationAnnual Meeting, pursuant to the rules of whetherthe New York Stock Exchange, your broker, bank or other nominee will be permitted to vote for you without instruction only with respect to Proposal 2 regarding the ratification of PricewaterhouseCoopers LLP. A broker non-vote will not have any impact on the outcome of any other proposals. |

21. | Q: What is the vote required to approve each proposal? |

| | | | | | Item of Business | Votes Required for Approval | Abstentions | Signed But Unmarked Proxy Cards | Broker Non-Votes | | | | | | Proposal 1: Election of Directors | One Class II director will be elected by the highest number of affirmative votes of the shares of Class A and Class C Common Stock, voting together as a matter is approved.single class, present in person or represented by Proxy and entitled to vote. One Class II director will be elected by the highest number of affirmative votes of the shares of Class B and Class D Common Stock, voting together as a single class, present in person or represented by Proxy and entitled to vote. | No effect | Count as votes FOR | No effect on voting | | | | | |

| | | | | | Item of Business | Votes Required for Approval | Abstentions | Signed But Unmarked Proxy Cards | Broker Non-Votes | Proposal 2: Ratification of Independent Registered Public Accounting Firm | Majority of the Class A, B, C and D Common Stock votes, present in person or represented by Proxy and entitled to vote. | Count as votes AGAINST | Count as votes FOR | Not applicable | Proposal 3: Stockholder Proposal regarding Proxy Access | Majority of the Class A, B, C and D Common Stock votes, present in person or represented by Proxy and entitled to vote. | Count as votes AGAINST | Count as votes AGAINST | No effect on voting |

23.22. | Q: Who will count the votes? |

| A: | The Secretary will count the Class A and Class C votes. Our transfer agent will count the Class B and Class D votes and serve as inspector of elections. |

24.23. | Q: When are stockholder proposals due in order to be included in our Proxy Statement for the 20172020 Annual Meeting? |

| A: | Any stockholder proposal that you wishintended to presentbe included in the proxy materials for consideration at the 20172020 Annual Meeting must be received by us no later than December 8, 2016. This date provides sufficient time for inclusion6, 2019. Such proposals should be sent in writing by courier or certified mail to our Secretary at Universal Health Services, Inc., Universal Corporate Center, 367 South Gulph Road, P.O. Box 61558, King of the proposal in the 2017 Proxy Materials.Prussia, Pennsylvania 19406. Any stockholder proposal must also be in proper form and substance, as determined in accordance with the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder. Proposals should be addressed to our Secretary at Universal Health Services, Inc., Universal Corporate Center, 367 South Gulph Road, P.O. Box 61558, King of Prussia, Pennsylvania 19406. |

6

25.24. | Q: Can I receive more than one set of Annual Meeting materials? |

| A: | If you share an address with another stockholder, each stockholder may not receive a separate copy of our Annual Report and Proxy Statement. We will promptly deliver a separate copy of either document to any stockholder upon written or oral request to our Secretary at Universal Health Services, Inc., Universal Corporate Center, 367 South Gulph Road, P.O. Box 61558, King of Prussia, Pennsylvania 19406, telephone (610) 768-3300. If you share an address with another stockholder and (i) would like to receive multiple copies of the Proxy Statement or Annual Report to Stockholders in the future, or (ii) if you are receiving multiple copies and would like to receive only one copy per household in the future, please contact your bank, broker, or other nominee record holder, or you may contact us at the above address and phone number. |

26.25. | Q: How can I obtain additional information about the Company? |

| A: | Copies of our annual, quarterly and current reports we file with the Securities and Exchange Commission, or SEC, and any amendments to those reports, are available free of charge on our website, which is located at http://www.uhsinc.com. Copies of these reports will be sent without charge to any stockholder requesting it in writing to our Secretary at Universal Health Services, Inc., Universal Corporate Center, P.O. Box 61558, 367 South Gulph Road, King of Prussia, Pennsylvania 19406. The information posted on our website is not incorporated into this Proxy Statement. |

7

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT The following table sets forth as of March 22, 2016,19, 2019, the number of shares of our equity securities and the percentage of each class beneficially owned, within the meaning of Securities and Exchange Commission Rule 13d-3, and the percentage of our general voting power currently held, by (i) all stockholders known by us to own more than 5% of any class of our equity securities, (ii) all of our directors and nominees who are stockholders, (iii) the executive officers named in the Summary Compensation Table and (iv) all directors and executive officers as a group. Except as otherwise specified, the named beneficial owner has sole voting and investment power. No shares are currently pledged as security by any of our directors or executive officers. | | | | | | | | | | | | | | | | | | | | | | Title of Class | | Percentage

of General

Voting

Power(3) | | Name and Address of Beneficial Owner(1) | | Class A

Common

Stock(2) | | | Class B

Common

Stock(2) | | | Class C

Common

Stock(2) | | | Class D

Common

Stock(2) | | John H. Herrell 1021 10th Street, S.W. Rochester, MN 55902 | | | | | | | 29,267 | (5)(12) | | | | | | | | | | (5) | | | | | | | Robert H. Hotz Houlihan Lokey Howard & Zukin 245 Park Avenue, 20th Floor New York, NY 10167 | | | | | | | 53,661 | (5)(12) | | | | | | | | | | (5) | | | | | | | Alan B. Miller | |

| 5,163,885

| (6)

(18)(21) | |

| 8,312,380

| (4)(12)

(13)(19) | | | 661,688 | | | | | | 83.1 | % | | | | (69.1 | %) | | | (6.6 | %) | | | (99.7 | %) | | | | | | | | | | | | | Marc D. Miller | | | 1,641,815 | (7)(16)(18) | |

| 2,507,596

| (4)(12)

(15)(19)(20) | | | | | | | | | 2.5 | % | | | | (24.9 | %) | | | (2.6 | %) | | | | | | | | | | | | | | | | | Anthony Pantaleoni Norton Rose Fulbright US LLP 666 Fifth Avenue New York, NY 10103 | | | 633,138 | (5)(14)(17)(21) | |

| 822,436

| (4)(5)

(8)(12)(15) | | | 2,192 | (5) | | | | | | (5) | | | | | | | Lawrence S. Gibbs Cannonball Trading LLC 22 Trafalgar Drive Livingston, NJ 07039 | | | | | | | 7,504 | (5)(12) | | | | | | | | | | (5) | | | | | | | Eileen C. McDonnell The Penn Mutual Life Insurance Company 600 Dresher Road Horsham, PA 19044 | | | | | | | 9,713 | (5)(12) | | | | | | | | | | (5) | | | | | | | Debra K. Osteen | | | | | | | 210,940 | (5)(12) | | | | | | | | | | (5) | | | | | | | Steve G. Filton | | | | | | | 429,188 | (5)(12) | | | | | | | | | | (5) |

| | Title of Class | | | | | | | | | Name and Address of Beneficial Owner(1) | | Class A Common Stock(2) | | | | | | Class B Common Stock(2) | | | | | | Class C Common Stock(2) | | | | | | Class D Common Stock(2) | | | | | | Percentage of General Voting Power(3) | | | | Shares | | % | | | Shares | | % | | | Shares | | % | | | Shares | | % | | | | | | Alan B. Miller | | 5,163,885(6)(17)(20) | | 78.5% | | | 8,851,314(4)(11)(12)(18)(21) | | 9.7% | | | 661,688 | | 100% | | | | — | | | — | | | | 84.3 | % | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Marc D. Miller | | 1,641,815(7)(15)(17) | | 25.0% | | | 2,700,150(4)(11)(14)(18)(19) | | 3.1% | | | | — | | | — | | | | — | | | — | | | | 2.6 | % | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Elliot J. Sussman, M.D. The Villages Health 1149 Main Street The Villages, FL 32159 | | | — | | | — | | | 2,500(11) | | (5) | | | | — | | | — | | | | — | | | — | | | (5) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Robert H. Hotz Houlihan Lokey Howard & Zukin 245 Park Avenue, 20th Floor New York, NY 10167 | | | — | | | — | | | 86,465(11) | | (5) | | | | — | | | — | | | | — | | | — | | | (5) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Warren J. Nimetz Norton Rose Fulbright US LLP 1301 Avenue of the Americas New York, NY 10019 | | 615,330(13)(16)(20) | | | — | | | 789,256(4)(11)(14) | | (5) | | | | — | | | — | | | | — | | | — | | | (5) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Lawrence S. Gibbs Erdos Capital 48 Crescent Road Livingston, NJ 07039 | | | — | | | — | | | 40,463(11) | | (5) | | | | — | | | — | | | | — | | | — | | | (5) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Eileen C. McDonnell The Penn Mutual Life Insurance Company 600 Dresher Road Horsham, PA 19044 | | | — | | | — | | | 37,237(11) | | (5) | | | | — | | | — | | | | — | | | — | | | (5) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Steve G. Filton | | | — | | | — | | | 470,238(11)(24) | | (5) | | | | — | | | — | | | | — | | | — | | | (5) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Marvin G. Pember | | | — | | | — | | | 172,129(11) | | (5) | | | | — | | | — | | | | — | | | — | | | (5) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Wellington Management Company, LLP 280 Congress Street Boston, MA 02210 | | | — | | | — | | | 7,405,132(8) | | 8.8% | | | | — | | | — | | | | — | | | — | | | | 1.1 | % | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | BlackRock, Inc. 55 East 52nd Street New York, NY 10055 | | | — | | | — | | | 6,473,221(9) | | 7.7% | | | | — | | | — | | | | — | | | — | | | (5) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 | | | — | | | — | | | 9,246,684(10) | | 11.0% | | | | — | | | — | | | | — | | | — | | | | 1.4 | % | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Vanguard Specialized Funds—Vanguard Health Care Fund 100 Vanguard Blvd. Malvern, PA 19355 | | | — | | | — | | | 4,593,600(22) | | 5.5% | | | | — | | | — | | | | — | | | — | | | (5) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | FMR, LLC 245 Summer Street Boston, MA 02210 | | | — | | | — | | | 5,178,138(23) | | 6.2% | | | | — | | | — | | | | — | | | — | | | (5) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | All directors & executive officers as a group (10 persons) | | | 6,574,600 | | 99.96% | | | | 11,731,896 | | 12.6% | | | | 661,688 | | 100.0% | | | | — | | | — | | | | 87.6 | % |

8

| | | | | | | | | | | | | | | | | | | | | | Title of Class | | Percentage

of General

Voting

Power(3) | | Name and Address of Beneficial Owner(1) | | Class A

Common

Stock(2) | | | Class B

Common

Stock(2) | | | Class C

Common

Stock(2) | | | Class D

Common

Stock(2) | | Marvin G. Pember | | | | | | | 112,568 | (5)(12) | | | | | | | | | | (5) | | | | | | | Wellington Management Company, LLP 280 Congress Street Boston, MA 02210 | | | | | |

| 5,707,049

(6.3 | (9)

%) | | | | | | | | | | | | | | | | | BlackRock, Inc. 40 East 52nd Street New York, NY 10022 | | | | | |

| 7,482,201

(8.3 | (10)

%) | | | | | | | | | | | | | | | | | The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 | | | | | |

| 7,851,381

(8.7 | (11)

%) | | | | | | | | | | | | | | | | | All directors & executive officers as a group (10 persons) | | | (99.9 | %) | | | (12.8 | %)(4) | | | (99.9 | %) | | | | | 86.7 | % |

(1) | Unless otherwise shown, the address of each beneficial owner is c/o Universal Health Services, Inc., Universal Corporate Center, 367 South Gulph Road, King of Prussia, PA 19406. |

(2) | Each share of Class A, Class C and Class D Common Stock is convertible at any time into one share of Class B Common Stock. |

(3) | As to matters other than the election of directors, holders of Class A, Class B, Class C and Class D Common Stock vote together as a single class. Each share of Class A Common Stock entitles the holder thereof to one vote; each share of Class B Common Stock entitles the holder thereof to one-tenth of a vote; each share of Class C Common Stock entitles the holder thereof to 100 votes (provided the holder of Class C Common Stock holds a number of shares of Class A Common Stock equal to ten times the number of shares of Class C Common Stock that holder holds); and each share of Class D Common Stock entitles the holder thereof to ten votes (provided the holder of Class D Common Stock holds a number of shares of Class B Common Stock equal to ten times the number of shares of Class D Common Stock that holder holds). |

(4) | Includes shares issuable upon the conversion of Classes A, C and/or D Common Stock. |

(5) | Less than 1% of the class of stock or general voting power. |

(6) | Includes 400,000 shares of Class A Common Stock that are beneficially owned by Mr. Miller and are held by Mr. Miller in trust for the benefit of his spouse. |

(7) | Includes 521,821 shares of Class A Common Stock which are held by three trusts (the “2002 Trusts”) for the benefit of certain of Alan B. Miller’s family members of which Marc D. Miller (who is a named executive officer, director and the son of Alan B. Miller) and Mr. PantaleoniNimetz are trustees; and 532,194 shares held by the A. Miller Family, LLC, whose members are the 2002 Trusts. Marc D. Miller is the sole manager of the A. Miller Family, LLC and during his tenure as such, has voting and dispositive power with respect to the Class A Common Stock held by the A. Miller Family, LLC. |

9

(8) | Includes 680 shares of Class B Common Stock that are beneficially owned by Mr. Pantaleoni and are held by Mr. Pantaleoni in trust for the benefit of certain members of his family. |

(9) | These securities are held by Wellington Management Company,Group, LLP a registered investment adviser.and various of its affiliates. Wellington Management CompanyGroup LLP or its affiliates has shared power to vote or direct the vote of 1,399,6082,494,269 shares of our Class B Common Stock and shared power to dispose or to direct the disposition of 5,707,0497,405,132 shares of our Class B Common Stock. Information is based on Amendment No. 1114 to Schedule 13G dated February 11, 2016.14, 2019. |

(10)(9) | These securities are held by BlackRock,Blackrock, Inc. Blackrock, Inc. has sole power to vote with respect to 5,753,743 shares of our Class B Common Stock and sole power with respect to 6,473,221 shares to dispose or to direct the disposition of 6,473,221 shares of our Class B Common Stock. Information is based on Amendment No. 710 to Schedule 13G dated January 22, 2016.February 6, 2019. |

(11)(10) | These securities are held by The Vanguard Group. Vanguard Group has sole power to vote with respect to 167,71998,146 shares and shared power to vote or direct the vote with respect to 8,80029,588 shares of our Class B Common Stock and shared power to dispose with respect to 178,010125,627 shares and sole power with respect to 7,851,3819,121,057 shares to dispose or to direct the disposition of 7,673,3719,246,684 shares of our Class B Common StockStock. Information is based on Amendment No. 26 to Schedule 13G dated February 10, 2016.11, 2019. |

(12)(11) | Includes 2,133,7502,132,750 shares issuable pursuant to stock options to purchase Class B Common Stock held by our directors and executive officers and exercisable within 60 days of March 22, 201619, 2019 as follows: John H. Herrell (15,000)Elliot J. Sussman, M.D. (2,500) Robert H. Hotz (11,250)(33,750); Alan B. Miller (1,475,000); Marc D. Miller (202,500); Anthony Pantaleoni (15,000)(241,500); Lawrence S. Gibbs (7,500)(33,750); Eileen C. McDonnell (7,500); Debra K. Osteen (122,500)(30,000); Steve G. Filton (175,000); Warren Nimetz (2,500); and Marvin G. Pember (102,500)(138,750). |

(13)(12) | Includes 23,98428,061 restricted shares awarded during 20142016, 2017 and 2015,2018, net of vestings, pursuant to our 2010 Employees’ Restricted Stock Purchase Plan for Alan B. Miller. These shares are subject to forfeiture and vesting pursuant to the terms and conditions set forth in the applicable restricted stock agreements. |

(14)(13) | Does not include (i) 521,821 shares of Class A Common Stock which are held by the 2002 Trusts of which Mr. PantaleoniNimetz is a trustee, and; (ii) 532,194 shares of Class A Common Stock which are held by A. Miller Family, LLC whose members are the 2002 Trusts. Mr. PantaleoniNimetz disclaims any beneficial interest in the shares. |

(15)(14) | Includes 171,426 shares held by the three 2011 Family Trusts for the benefit of Alan B. Miller’s three children. Anthony PantaleoniWarren Nimetz and Marc D. Miller are both Trustees. Marc D. Miller has sole voting power with respect to these shares. Mr. PantaleoniNimetz disclaims beneficial ownership of all shares and Marc D. Miller disclaims beneficial ownership of Abby Miller King’s shares (55,763) and Marni Spencer’s shares (55,763). |

(16)(15) | Includes 237,800 shares held by the 2012 Family Trust for the benefit of Abby Miller King and Marni Spencer. Anthony PantaleoniWarren Nimetz and Marc D. Miller are both Trustees. Marc D. Miller has sole voting power with respect to these shares. Mr. PantaleoniNimetz disclaims beneficial ownership of these shares.shares and Marc D. Miller disclaims beneficial ownership of Abby Miller King’s shares (118,900) and Marni Spencer’s shares (118,900). |

(17)(16) | Includes 356,700 shares held by the 2012 Family Trust for the benefit of Alan B. Miller’s three children. Anthony PantaleoniWarren Nimetz is the Trustee of Marc D. Miller’s shares (118,900) and Mr. PantaleoniNimetz has sole voting power with respect to Marc D. Miller’s shares. Mr. PantaleoniNimetz disclaims beneficial ownership of these shares. |

10

(18)(17) | Includes 350,000 shares held by three separate limited liability companies 100% of the interests of which are held by the three 20142018 Grantor Retained Annuity Trusts, Alan B. Miller, and the three 2015 Grantor Retained Annuity2002 Trusts for the benefit of Alan B. Miller’s three children. Alan B. Miller has the sole dispositive power and Marc D. Miller has sole voting power with respect to these shares. Marc D. Miller disclaims beneficial ownership of Abby Miller King’s shares (100,000) and Marni Spencer’s shares (100,000). |

(19)(18) | Includes 300,000400,000 shares held by the three separate limited liability companies 100% of the interests of which are held by 20142018 Grantor Retained Annuity Trusts, Alan B. Miller, and the three 2015 Grantor Retained Annuity2002 Trusts for the benefit of Alan B. Miller’s three children. Alan B. Miller has the sole dispositive power and Marc D. Miller has sole voting power with respect to these shares.shares. Marc D. Miller disclaims beneficial ownership of Abby Miller King’s shares (100,000) and Marni Spencer’s shares (100,000). |

(20)(19) | Includes 130,604110,172 shares held by the three 2002 Trusts for the benefit of Alan B. Miller’s three children. Anthony PantaleoniWarren Nimetz is a Trustee and disclaims beneficial ownership of these shares. Marc D. Miller has sole voting power with respect to these shares.shares and Marc D. Miller disclaims beneficial ownership interest of Abby Miller King’s shares (22,815) and Marni Spencer’s shares (43,247). |

(21)(20) | Includes 258,630 shares held by The Alan B. Miller 2002 Trust. Anthony PantaleoniWarren Nimetz is the Trustee of the Trust and has sole voting power with respect to these shares. Mr. PantaleoniNimetz disclaims any beneficial interest in the shares. |

(21) | Excludes 10,810 shares in The Alan and Jill Miller Foundation. |

(22) | These securities are held by Vanguard Specialized Funds - Vanguard Health Care Fund. Vanguard Specialized Funds - Vanguard Health Care Fund has sole power to vote with respect to 4,593,600 shares of our Class B Common Stock and holds no dispositive power. Information is based on Amendment No. 2 of Schedule 13G dated February 1, 2019. |

(23) | These securities are held by FMR, LLC and its affiliates. FMR, LLC has sole power to vote with respect to 559,345 shares of our Class B Common Stock and sole power with respect to 5,178,138 shares to dispose or to direct the disposition of 5,178,138 shares of our Class B Common Stock. Information is based on the initial filing of Schedule 13G dated February 13, 2019. |

(24) | Includes 45,000 shares pledged to Merrill Lynch as collateral in connection with a personal loan extended to Mr. Filton. |

Equity Compensation Plan Information The table below provides information, as of the end of December 31, 2015,2018, concerning securities authorized for issuance under our equity compensation plans. | Plan Category (1.) | | (a)

Number of

Securities to be

Issued Upon

Exercise of

Outstanding

Options, Warrants

and Rights (2.) | | | (b)

Weighted Average

Exercise Price of

Outstanding

Options, Warrants

and Rights | | | (c)

Number of Securities

Remaining Available

for Future Issuance under

Equity Compensation

Plans (excluding

securities reflected in

column (a)) (3.) | | | (a) Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (2.) | | | (b) Weighted Average Exercise Price of Outstanding Options, Warrants and Rights | | | (c) Number of Securities Remaining Available for Future Issuance under Equity Compensation Plans (excluding securities reflected in column (a)) (3.) | | Equity compensation plans approved by security holders | | | 8,400,183 | | | $ | 80.50 | | | | 8,372,888 | | | | 9,674,791 | | | $ | 115.39 | | | | 7,298,643 | | | | | | | | | | | | | Total | | | 8,400,183 | | | $ | 80.50 | | | | 8,372,888 | | | | 9,674,791 | | | $ | 115.39 | | | | 7,298,643 | | | | | | | | | | | | |

(1)(1.) | Shares of Class B Common StockStock. |

(2)(2.) | As of March 22, 2016,27, 2019, there were 7,894,97110,385,707 options outstanding with a weighted-average exercise price of $82.45$123.55 and a weighted-averageweighted average remaining term of 2.83.22 years. In addition, there were 40,984292,837 full-value shares outstanding as of March 22, 2016.27, 2019. |

(3)(3.) | As of March 22, 2016,27, 2019, the Company’s Stock Incentive Plan had 6,933,0413,910,300 shares remaining for future issuance, and the Restricted Stock Purchase Plan had 498,975197,543 shares remaining for future issuance, for a total of 7,432,0164,107,843 shares. |

11

PROPOSAL NO. 1 ELECTION OF DIRECTORS Our Restated Certificate of Incorporation provides for a Board of Directors of not fewer than three members nor more than nine members. The Board of Directors is currently fixed atcomprised of seven members, and is divided into three classes, with members of each class serving for a three-year term. At each Annual Meeting of Stockholders, directors are chosen to succeed those in the class whose term expires at such Annual Meeting and, in the case of this Annual Meeting, directors will be elected as Class II directors. Under our Restated Certificate of Incorporation, holders of shares of our outstanding Class B and Class D Common Stock (voting together as a single class) are entitled to elect 20% (but not less than one) of the directors, currently two directors, one in Class II and one in Class III, and the holders of Class A and Class C Common Stock (voting together as a single class) are entitled to elect the remaining five directors, three in Class I, one in Class II, and one in Class III. The persons listed below include our Board of Directors and nominees. The terms of the two current Class II directors, Mr.Messrs. Warren J. Nimetz and Robert H. Hotz, and Mr. Anthony Pantaleoni expire at the 20162019 Annual Meeting. Mr. Robert H.Nimetz has been nominated to be elected by the holders of Class A and C Common Stock and Mr. Hotz has been nominated to be elected by the holders of Class B and Class D Common Stock and Mr. Anthony Pantaleoni has been nominated to be elected by the holders of Class A and C Common Stock. We have no reason to believe that any of the nominees will be unavailable for election; however, if either nominee becomes unavailable for any reason, the shares represented by the Proxy will be voted for the person, if any, who is designated by the Board of Directors to replace the nominee. All nominees have consented to be named and have indicated their intent to serve if elected. The following information is furnished with respect to each of the nominees for election as a director and each member of the Board of Directors whose term of office will continue after the meeting. | Name | | Class of

Director | | Class of

Stockholders

Entitled to Vote | | Age | | | Business Experience | | Director

Since | | | Class of Director | | Class of Stockholders Entitled to Vote | | Age | | Business Experience | | Director Since | DIRECTOR NOMINEES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Anthony Pantaleoni | | II | | A Common

C Common | | | 76 | | | Of Counsel to the law firm of Norton Rose Fulbright US LLP., New York, New York. We utilized during the year ended December 31, 2015 and currently utilize the services of Norton Rose Fulbright US LLP as outside counsel. | | | 1982 | | | Warren J. Nimetz | | | II | | A Common C Common | | 62 | | Mr. Nimetz is a Partner at the law firm of Norton Rose Fulbright and has been an attorney since 1979. We utilized during the year ended December 31, 2018, and currently utilize, the services of Norton Rose Fulbright as outside counsel. | | 2018 | | | | | | | | | | | | | | | | | | | | | | | | | | | | Robert H. Hotz | | II | | B Common

D Common | | | 71 | | | Senior Managing Director, Co-Head of Corporate Finance, Co-Chairman of Houlihan Lokey Howard & Zukin, Member of the Board of Directors and Operating Committee, Houlihan Lokey Howard & Zukin since June 2002. | | | 1991 | | | II | | B Common D Common | | 74 | | Senior Managing Director, Global Co-Head of Corporate Finance, and Vice Chairman of Houlihan Lokey Howard & Zukin. Member of the Operating Committee, Houlihan Lokey Howard & Zukin since June 2002. Previously a member of the Board of Directors, Houlihan Lokey Howard & Zukin and Senior Vice Chairman, Investment Banking for the Americas of UBS LLC. | | 1991 | | | | | | | | | | | | |

Name | | Class of Director | | Class of Stockholders Entitled to Vote | | Age | | Business Experience | | Director Since | DIRECTORS WHOSE TERMS EXPIRE IN 2020 | | | | | | | | | | | | | | | | | | | | | | Alan B. Miller | | III | | A Common C Common | | 81 | | Our Chairman of the Board and Chief Executive Officer since 1978 and previously served as President until May 2009. Prior thereto, President, Chairman of the Board and Chief Executive Officer of American Medicorp, Inc. Chairman of the Board of Trustees, Chief Executive Officer and President of Universal Health Realty Income Trust. Father of Marc D. Miller, a Director and President. | | 1978 | | | | | | | | | | | | Lawrence S. Gibbs | | III | | B Common D Common | | 47 | | Chief Investment Officer at Erdos Capital since January 2017. Previously served in various portfolio manager and chief investment officer roles including portfolio manager at JP Morgan Chase Bank NA. | | 2011 | | | | | | | | | | | |

Name | | Class of Director | | Class of Stockholders Entitled to Vote | | Age | | Business Experience | | Director Since | DIRECTORS WHOSE TERMS EXPIRE IN 2021 | | | | | | | | | | | Elliot J Sussman, M.D. | | I | | A Common C Common | | 67 | | Chairman of the Villages Health. Former President and Chief Executive Officer of Leigh Valley Hospital and Health Network from 1993 to 2010. Currently, a member of the Board of Directors of Yale New Haven Health System since 2011. | | 2018 | | | | | | | | | | | | Marc D. Miller | | I | | A Common C Common | | 48 | | Appointed as our President in May 2009. Previously served as Senior Vice President and Co-Head of our Acute Care Division during 2007 and served as a Vice President since January 2005. Served as Vice-President of our Acute Care Division since August 2004; Assistant Vice President and Group Director of Acute Care Division, Eastern Region since June 2003, and; served in other management positions at various hospitals from 1999 to 2003. Currently serves as a member of the Board of Trustees of Universal Health Realty Income Trust and as a member of the Board of Directors of Premier, Inc. Son of Alan B. Miller, our Chief Executive Officer and Chairman of the Board. | | 2006 | | | | | | | | | | | |

Name | | Class of Director | | Class of Stockholders Entitled to Vote | | Age | | Business Experience | | Director Since | Eileen C. McDonnell | | I | | A Common C Common | | 56 | | Ms. McDonnell currently serves as Chairman and Chief Executive Officer of The Penn Mutual Life Insurance Company since her appointment in February 2011. Ms. McDonnell joined Penn Mutual in 2008 and previously served as President of the company. She was also appointed to The Penn Mutual Board of Trustees in 2010. Ms. McDonnell also serves on the Board of Janney Montgomery Scott LLC, a wholly owned subsidiary of Penn Mutual. Before joining Penn Mutual, Ms. McDonnell founded ExecMPower, a strategic planning and executive coaching consultancy. Previously, she was president of New England Financial, a wholly-owned subsidiary of MetLife, and senior vice president of the Guardian Life Insurance Company. Ms. McDonnell serves as the Chairman of the Insurance Federation of Pennsylvania. She also serves on the Corporate Council of Children’s Hospital of Philadelphia and is a national advisor to Vision 2020, an initiative of Drexel University College of Medicine Institute for Women’s Health and Leadership. | | 2013 |

12

| | | | | | | | | | | | | | | Name | | Class of

Director | | Class of

Stockholders

Entitled to Vote | | Age | | | Business Experience | | Director

Since | | DIRECTORS WHOSE TERMS EXPIRE IN 2017 | | | | | | | | | | | | | | | | | | | | | Alan B. Miller | | III | | A Common

C Common | | | 78 | | | Our Chairman of the Board and Chief Executive Officer since 1978 and previously served as President until May 2009. Prior thereto, President, Chairman of the Board and Chief Executive Officer of American Medicorp, Inc. Chairman of the Board of Trustees, Chief Executive Officer and President of Universal Health Realty Income Trust. Father of Marc D. Miller, a Director and President. | | | 1978 | | | | | | | | Lawrence S. Gibbs | | III | | B Common

D Common | | | 44 | | | Managing Partner at Cannonball Trading, LLC since July 2014. Previously served as a Macro Portfolio Manager at Ramius LLC from March 2010 until July 2014. Prior thereto, Portfolio Manager at Millennium Partners LLC from February 2009 to March 2010. | | | 2011 | | DIRECTORS WHOSE TERMS EXPIRE IN 2018 | | | | | | | | | | | | | | | | | | | | | John H. Herrell | | I | | A Common

C Common | | | 75 | | | Former Chief Administrative Officer of Mayo Foundation from 1993 through 2002; Chief Financial Officer of Mayo Foundation from 1984 until 1993 and various other capacities since 1968. | | | 1993 | | | | | | | | Marc D. Miller | | I | | A Common

C Common | | | 45 | | | Appointed as our President in May 2009. Previously served as Senior Vice President and Co-Head of our Acute Care Division during 2007 and served as a Vice President since January 2005. Served as Vice-President of our Acute Care Division | | | 2006 | |

13

| | | | | | | | | | | | | | | Name | | Class of

Director | | Class of

Stockholders

Entitled to Vote | | Age | | | Business Experience | | Director

Since | | | | | | | | | | | | since August 2004; Assistant Vice President and Group Director of Acute Care Division, Eastern Region since June 2003, and; served in other management positions at various hospitals from 1999 to 2003. Currently serves as a member of the Board of Trustees of Universal Health Realty Income Trust and as a member of the Board of Directors of Premier, Inc. Son of Alan B. Miller, our Chief Executive Officer and Chairman of the Board. | | | | | | | | | | | Eileen C. McDonnell | | I | | A Common

C Common | | | 53 | | | Ms. McDonnell was appointed to our Board of Directors in April, 2013 and she currently serves as Chairman and Chief Executive Officer of The Penn Mutual Life Insurance Company since her appointment in February, 2011. Ms. McDonnell joined Penn Mutual in 2008 and previously served as President of the company. She was also appointed to The Penn Mutual Board of Trustees in 2010. Before joining Penn Mutual, Ms. McDonnell founded ExecMPower, a strategic planning and executive coaching consultancy. Previously, she was president of New England Financial, a wholly-owned subsidiary of MetLife, and senior vice president of the Guardian Life Insurance Company. | | | 2013 | |

See the “Corporate Governance” section for additional information about our Board of Directors. THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THESE NOMINEES AS DIRECTORS.

14

PROPOSAL NO. 2 RATIFICATION OF THE SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS The Audit Committee of the Board has selected, and as a matter of good corporate governance, is requesting ratification by the shareholdersstockholders of the selection of PricewaterhouseCoopers LLP to serve as our independent registered public accountants for the year ending December 31, 2016.2019. PricewaterhouseCoopers LLP has served as our independent registered public accountants for the year ended December 31, 2015.since 2007. If a favorable vote is not obtained, the Audit Committee may reconsider the selection of PricewaterhouseCoopers LLP. Even if the selection is ratified, the Audit Committee, in its discretion, may select different independent auditors if it subsequently determines that such a change would be in the best interest of the Company and its shareholders.stockholders. PricewaterhouseCoopers LLP representatives will attend the Annual Meeting and respond to questions where appropriate. Such representatives may make a statement at the Annual Meeting should they so desire. Vote Required Ratification of the selection of the independent registered public accountants by the shareholdersstockholders requires that affirmative “FOR” vote of the holders of a majority of the Class A, Class B, Class C and Class D Common Stock votes present in person or represented by proxy and entitled to vote on the matter. Unless marked to the contrary, proxies will be voted FOR the ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accountants. THE BOARD RECOMMENDS THAT SHAREHOLDERSSTOCKHOLDERS VOTE FOR THE RATIFICATION OF THE SELECTION OF PRICEWATERHOUSECOOPERS LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS FOR THE FISCAL YEAR ENDING DECEMBER 31, 2016.2019.

15

PROPOSAL NO. 3 SHAREHOLDERSTOCKHOLDER PROPOSAL REGARDING SHAREHOLDERSTOCKHOLDER PROXY ACCESS

We have been notified that the Comptroller of the City of New York, Scott M. Stringer, as the custodian and a trustee of the New York City Employees’ Retirement System, the New York City Fire Department Pension Fund, the New York City Teachers’ Retirement System, and the New York City Police Pension Fund, and custodian of the New York City Board of Education Retirement System (the “Systems”) intends to present a non-binding proposal for consideration at the Annual Meeting. The Comptroller of the City of New York represents that each System intends to continue to hold at least $2,000 worth of securities of Universal Health Services, Inc., (“UHS”) through the Systems, collectively, are the beneficial ownersdate of 197,080 shares of common stock.UHS’ next annual meeting. The stockholders making this proposal have provided the proposal and supporting statement, which is set forth below. The Board opposes adoption of the proposal and asks stockholders to review the Board’s statement in opposition to the proposal, which follows the stockholders’ proposal and supporting statement below. ShareholderStockholder Proposal Regarding Proxy Access

RESOLVED: Shareholders of the Universal Health Services, Inc. (“UHS”(the “Company”) ask the board of directors (“Board”(the “Board”) to take the steps necessary to adopt a “proxy access” bylaw. TheSuch a bylaw shouldshall require UHSthe Company to include in proxy materials prepared for a shareholder meeting at which Class B/D directors are to be elected the name, Disclosure and Statement (defined below)(as defined herein) of any person nominated for election as a Class B/D directorto the board by a Class B/D shareholder or group (“Nominator”(the “Nominator”) satisfyingthat meets the criteria established below andbelow. The Company shall allow Class B/D shareholders to vote on such nominee(s)nominee on UHS’sthe Company’s proxy card. The number of shareholder-nominated candidates nominated pursuant to the bylaw for a given meeting shouldappearing in proxy materials shall not exceed the larger of two or one quarter of the directors then comprising the Board, subject to any limitations on the number of Class B/D directors to be elected by Class B/D shareholders at the meeting. (Currently, holders of Class B and D shares elect two of UHS’s seven directors, and they are in different classes resulting from UHS’s classified board.)serving. This bylaw, which supplementsshall supplement existing rights under Company bylaws, should provide that a Nominator must: | a) | Not be an executive officer or director of UHS; |

| b)a) | have beneficially owned 3% or more of UHS’sthe Company’s outstanding Class B or D common stock continuously for at least three years;years before submitting the nomination; |

| c)b) | give UHS,the Company, within the time period identified in its bylaws, written notice of the information required by the bylaws and any SECSecurities and Exchange Commission rules about (i) the nominee;nominee, including consent to being named in the proxy materials and to serving as director if elected; and (ii) the Nominator, including proof it owns the required shares (information required by this subsection is the(the “Disclosure”); and |

| d)c) | certify that (i) it will assume liability stemming from any legal or regulatory violation arising out of the Nominator’s communications with UHSthe Company shareholders, including the Disclosure and Statement; (ii) it will comply with all applicable laws and regulations if it uses soliciting material other than UHS’sthe Company’s proxy materials; and (iii) to the best of its knowledge, the required shares were acquired in the ordinary course of business and not to change or influence control at UHS.the Company.. |

16

The Nominator may submit with the Disclosure a statement not exceeding 500 words in support of each nominee (the “Statement”). The Board shall adopt procedures for promptly resolving disputes over whether notice of a nomination was timely, whether the Disclosure and Statement satisfy the bylaw and applicable rules,federal regulations, and the priority to be given whento multiple nominations exceeding the limit on nominees is exceeded.one-quarter limit.

SUPPORTING STATEMENT We believe proxy access is a fundamental shareholder right that will make directors more accountable and enhance shareholder value. A 2014 study by the CFA Institute study concluded that proxy access would “benefit both the markets and corporate boardrooms, with little cost or disruption and could raise overall US market capitalization by up to $140.3 billion if adopted market-wide. market-wide, “with little cost or disruption.” ((http://www.cfapubs.org/doi/pdf/10.2469/ccb.v2014.n9.1) The proposed terms are similar to those in vacated SEC Rule 14a-11 (https://www.sec.gov/rules/final/2010/33-9136.pdf). The SEC, following extensive analysis and input from market participants, determined that those terms struck the proper balance of providing shareholders with viable proxy access while containing appropriate safeguards. The proposed terms enjoy strong investor support. Through November 2015,support and company acceptance. We believe a similar proposal received a majority of non-insider votes oncast at the company in 2018. Additionally, more than 100 similar proposals have averaged 55% and more than 70440 companies have enacted bylaws with similar proxy access bylaws for 3% shareowners.terms. We urge shareholders to vote FOR this proposal.

17

MANAGEMENT’S STATEMENT IN OPPOSITION TO STOCKHOLDER PROPOSAL This is the fourth consecutive year that our stockholders have been asked to vote on this proposal or a substantially similar proposal regarding “proxy access.” Each “proxy access” proposal submitted to stockholders at our annual meetings has received the support of less than 10% of the common stock votes represented in person or by proxy at the meeting. Our Board of Directors continues to believe that the implementation of proxy access is not in the best interests of our Company. The Board has carefully considered this specific proposal and recommends a vote AGAINST it. It is the foregoing proposal forBoard of Directors’ view that our corporate governance policies already ensure that the following reasons: Proxy accessBoard of Directors is a procedure designedaccountable to facilitate company-financed proxy contests in director elections, pitting the Board’s nominees against one or more proxy access candidates nominated by a stockholder to be included in the Company’s proxy statement. The Board recommendsstockholders, and that you vote against this proposal because it ignores the voice stockholders already have, undercutswould undercut the role that the Board of Directors and the independent Nominating and Governance Committee andplay in evaluating director nominees. This proposal calls for you to approve a process that would introduce an unnecessary andenable special interest groups collectively owning as little as 3% of the Company’s outstanding shares to nominate directors that promote their own agendas, potentially expensive and destabilizing dynamic intoat the expense of the long-term interests of stockholders. With non-management directors constituting 70% of the Board election process.of Directors and routinely receiving more than 90% of all votes cast, and our enhanced stockholder engagement program, the Company already has a Board of Directors that is accountable to stockholders, responsive to your input, and committed to promoting your best interests.

This proposal advances a solution for a problem that does not exist at the Company, as the Company’sour current corporate governance policies and practices provide stockholders with the ability to effectively express their views and participate meaningfully in director elections, and ensure that the Board of Directors is accountable to stockholders.stockholders. For example, As a “controlled company” for purposes of NYSE Listed Company Manual Section 303A.00, we are not required to have a majority of independent directors and we are exempt from the NYSE’s requirements relating to compensation committees and nominating/corporate governance committees. However, the Company has a majority of independent directors on our Board of Directors and all independent directors serving on our Compensation Committee and Nominating & Governance Committee. We believe that our Board and committee structure provides independence and good corporate governance practices while our multi-tiered voting structure preserves our ability to manage the Company in the best interests of all our shareholders.stockholders. We have an empowered independent Lead Independent Director. ShareholdersStockholders are able to:

| • | | Communicateo

| communicate directly with any director, including our independent directors, as discussed in this Proxy Statement under “Stockholder“Stockholder Communications”; |

| o | propose director nominees to the Nominating and Governance Committee; |

| o | directly submit nominations of director candidates at our annual meetings, subject to the conditions set forth in our By-laws; and |

| o | submit proposals for consideration at our annual meetings and for inclusion in the Company’s proxy statement. |

Propose director nominees to the Nominating and Governance Committee; and

Directly submit nominations of director candidates at our annual meetings, subject to the conditions set forth in our By-laws.

We do not have a “poison pill” which would limit the amount of shares any group of stockholders could hold. Since its founding in 1979 UHS has become one of the largest and most respected hospital management companies in the nation. As a Fortune 500 corporation, with net revenues of approximately $9.0$10.8 billion in annual revenuegenerated during the year ended December 31, 2018 that produced net income of more than $680approximately $800 million, in 2015, UHS subsidiaries own and operate 260350 inpatient acute care and behavioral health care facilities in 37 states, the District of Columbia, Puerto Rico, the U.S. Virgin Islands and the United Kingdom, and employ more than 74,00087,000 people. Our governance structure has enabled us to grow our 18

business and to succeed despite a rapidly changing landscape and changes in technology, market structure and regulatory regimes. The tenure of our directors enables the Board to provide insight into the rationale and historical context for past decisions and strategies that has allowed us to successfully adapt to our evolving business environment. This continuity increases the full Board’s collective experience, provides new directors the opportunity to learn about our business from the continuing directors and improves the Board’s ability to develop, refine, and execute our long-term strategic plans. All of this is even more important in today’s uncertain environment with increased challenges and opportunities facing companies within the healthcare industry. An abrupt change in the composition of our Board could impair our progress in achieving our strategic goals. The proposal would undermine the important role of the independent Nominating and Governance Committee. Allowing stockholders to nominate competing candidates for director in our proxy statement would seriously undercut the role of the independent Nominating and Governance Committee and our Board in one of the most crucial elements of corporate governance, the election of directors. An effective Board of Directors is composed of individuals with a diverse and complementary blend of experiences, skills and perspectives. Our independent Nominating and Governance Committee and our Board of Directors are in the best position to assess the particular qualifications ofidentify potential director nominees with the experience and qualities to serve on the Board of Directors, and to determine whether theysuch candidates will contribute to an effective and well-rounded Board that operates openly and collaboratively and represents the interests of all stockholders, not just those with special interests.

The Nominating and Governance Committee, which is comprised of independent, non-management directors who owe fiduciary duties to act in the best interests of all stockholders, has developed criteria and a process for identifying and recommending director candidates for election by our Class B and D stockholders, which are described in this Proxy Statement under “Committees of the Board of Directors-Nominating and Governance Committee.”

As part of this process, stockholders can recommend prospective director candidates for the Nominating and Governance Committee’s consideration. No stockholders have recommended prospective director candidates through this process to date, which we believe reflects the confidence of our stockholders in the nomination process of the Nominating and Governance Committee outlined above. However, any nominee proposed by stockholders for the Committee’s consideration through this process would be evaluated and considered in the same manner as a nominee recommended by a Board member, management, search firm or other source.

This process is designed to identify and nominate qualified director candidates who possess a combination of skills, professional experience and diversity of backgrounds necessary to oversee our business and who can contribute to the overall effectiveness of our Board. The Nominating and Governance Committee also carefully reviews and considers the independence of potential nominees. ShareholdersStockholders already have a voice in this process and the ability to nominate potential directors for consideration by the Committee. Through this process, we believe that our Nominating and Governance Committee and Board achieve the optimal balance of identifying and nominating directors andthat best serve the Company and all of our stockholders.

This proxy access proposal would potentially enable a holder, or a group of holders, with ownership of as little as 3% of our outstanding shares to completely bypass this process by placing directly into nomination 19

candidates who may fail to meet the qualifications established by the Board, fail to contribute to the desired mix of perspectives, or fail to represent the interests of stockholders as a whole. In addition,For example, the Board of Directors believes that this proposal ifinvites the influence of special interest groups who do not owe fiduciary duties to the Company on decisions that are more appropriately made by the Board of Directors. Were this proposal implemented, would allow a constantly shifting alignmentsmall group of stockholders that have held sharescould nominate directors with a special interest agenda, or a slate of nominees focused on short-term interests rather than creating long-term value for, and promoting the requisite three-year period to aggregate their shares to reachbest interests of, all stockholders. The Board of Directors does not believe this 3% threshold creating a never ending cycleis in the best interests of stockholders seeking to disrupt the Company’s governance.Company or its stockholders. The proposal could have a number of other significant adverse consequences. In addition, to proxy access being unnecessary, the Board believes that the potential for frequent contested elections arising from proxy access would not only be highly distracting to the Board and management, but could also encourage a short-term focus with respect to the management of the business that would not be in the long-term interests of our stockholders. We believe that our Board’s stability has driven, and will continue to drive, long-term value for stockholders who are committed to holding our stock for extended periods. As a testament to this belief, our shares have outperformed leading stock indices by significant margins since our initial public offering in 1981. More recently,

since 2000, our stock performance has outperformed the S&P 500 Index by a margin of 5.7 to 1 during the 19-year period ended December 31, 2018. After various stock splits and reinvested dividends are considered, an investor who purchased $1,000 of our Class B Common Stock on January 1, 2000, would have had an investment valued at $14,040 as proposed in this stockholder proposal could have a number of significant adverse consequences and harm the Company and stockholders by: | • | | Creating an Uneven Playing Field and Increasing Company Costs. In the absence of proxy access, the playing field is level, in that a stockholder seeking to elect its own nominee to the Board outside of the process of the Nominating and Governance Committee outlined above would, like the Company, need to undertake the expense of preparing proxy materials and soliciting proxies on its nominee’s behalf. We see little reason why a stockholder owning 3% or more of the outstanding shares of the Company (which as of the record date would constitute over $320 million worth of shares) should not, if the stockholder has a legitimate interest in having representation on the Board, bear the expense of preparing proxy materials and soliciting proxies. Moreover, in a contested election resulting from proxy access, we would likely feel compelled to undertake an additional and potentially expensive campaign in support of Board-nominated candidates and inform stockholders of the reasons why we believe the Board-nominated candidates rather than the stockholder nominee(s) should be elected. In this regard, the United States Court of Appeals for the District of Columbia overturned the SEC’s proxy access rule because it determined that the SEC failed to adequately assess the economic effects of the rule, including the expense and distraction that contested director elections arising out of proxy access would entail.

|

| • | | Increasing the Influence of Special Interest Groups. Proxy access creates the potential for a stockholder with a special interest to use the proxy access process to promote a specific agenda rather than the interests of all stockholders or to extract concessions from the Company related to that stockholder’s special interests, thereby creating the risk of politicizing the Board election process at virtually no cost to the proponent.

|

| • | | Encouraging Short-Termism. With proxy access, contested director elections could become routine. The Board believes that the potential for frequent contested elections arising from proxy access would not only be highly distracting to the Board and management, but could also encourage a short-term focus with respect to the management of the business that would not be in the long-term interests of our stockholders. We believe that our Board’s stability has driven, and will continue to drive, long-term value for stockholders who are committed to holding our stock for extended periods. As a testament to this belief, our shares have outperformed leading stock indices by significant margins since our initial public offering in 1981. More recently, since 2000, our stock performance has outperformed the S&P 500 Index by a margin of more than 7.5 to 1 during the 16-year period ended December 31, 2015. After various stock splits and reinvested dividends are considered, an investor who purchased $1,000 of our Class B Common Stock on January 1, 2000, would have had an investment valued at $14,249 as of

|

20

| December 31, 2015, as compared to $1,891December 31, 2018, as compared to $2,466 for a $1,000 investment made in the S&P 500 Index during the same period.

|

| • | | Disrupting Board Operations. Frequent contested director elections arising out of proxy access could also disrupt our Board operations and dynamics in various ways. Abrupt changes in the composition of our Board arising out of proxy access could disrupt continuity on our Board in a manner that could interfere with our ability to develop, refine, monitor and execute our long-term strategic and business plans. In addition, the election of stockholder-nominated directors through proxy access could create factions on the Board, leading to dissension and delay, and thereby potentially preclude the Board’s ability to function effectively and serve the best interests of all our stockholders. Finally, the potential for frequent contested elections arising out of proxy access could hinder collegiality among our Board members by creating the potential for our Board members to be pitted against one another in contested director elections on a regular basis where there would be more nominees up for election than available director positions.

|